Special Assessments Florida Can Be Fun For Everyone

Table of ContentsSpecial Assessments Florida Can Be Fun For EveryoneMore About Special Assessments FloridaIndicators on Special Assessments Florida You Should KnowThe 10-Second Trick For Special Assessments FloridaThe 30-Second Trick For Special Assessments FloridaSpecial Assessments Florida Can Be Fun For Everyone

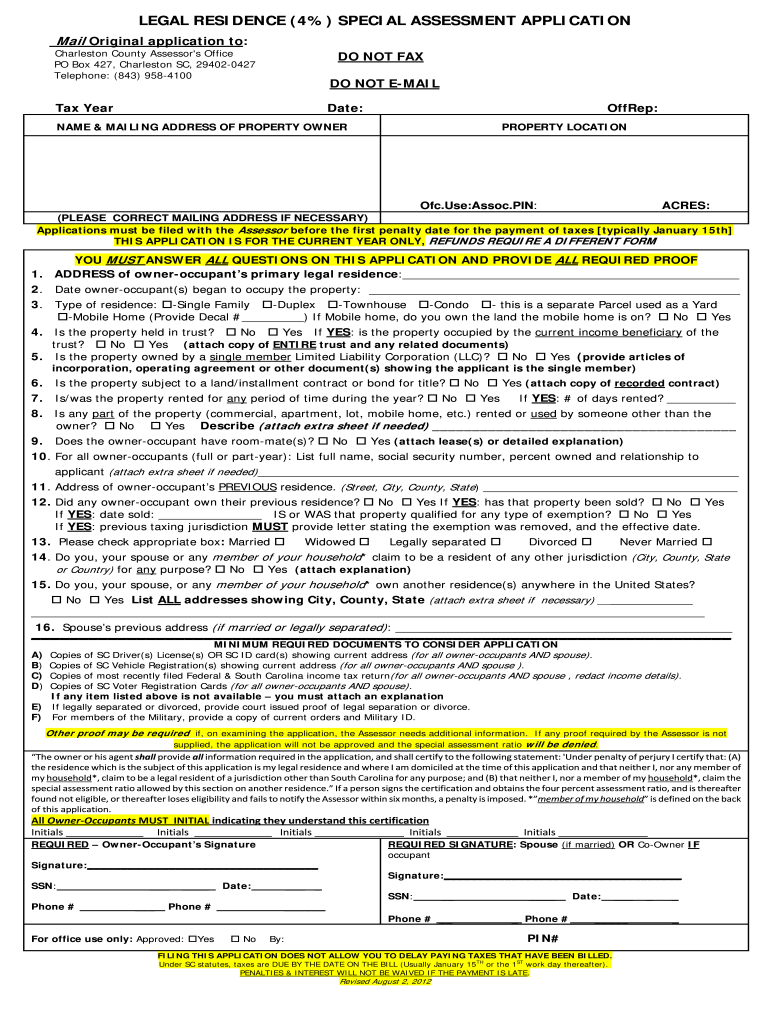

- $99 annually as well as changed for inflation yearly. The funds produced by this tax will certainly be made use of to maintain as well as enhance the quality of education and learning at City University campuses, consisting of core academics, labor force training, college prep work, libraries as well as innovation. There are no senior or low income exceptions, as state legislation does not attend to such exemptions.An unique assessment is an added tax obligation on a piece of building, usually in the type of property tax. This added assessment is collected by the local taxing authority and also routed to a designated fund to finance tasks, improvements or programs for the examined district. Special evaluation districts are a common growth financing device.

The majority of states offer more than one alternative. These devices are known by a selection of names and can be structured in a selection of ways, however there are two primary approaches. The National Association of Residence Builders released this report focusing on Special Objective Taxing Districts, a much more efficient and also reliable method to money public renovations in advancement of development, while at the exact same time guaranteeing that new development pays for the enhancements.

The Tax Increment Finance Recommendation Guide addresses what TIF is, why it ought to be utilized and also just how finest to apply the TIF device. The recommendation guide likewise highlights both TIF as well as unique evaluation tasks from across the country as well as talks about exactly how they can be put on address several typical financial growth concerns.

are a tax which is charged to money enhancements. The charge just applies to those homes which will certainly profit from the renovation. The procedure is rather straightforward. It is started by either a team of homeowner or the city government. Either entity will launch the process by taking a proposal to whoever is in cost of levying assessments in your area.

Fascination About Special Assessments Florida

The cash collected with unique assessments can money the building of sewers, streets, drain, and also watering. Additionally, special analyses can be used to money the growth of parks and also recreational centers.

The bigger the front-foot measurement of a whole lot, the greater the assessment the great deal proprietor will certainly pay. The front-foot dimension of a whole lot is each foot of a whole lot that abuts the road being improved. On the other hand, it might be assigned on a fractional basis, where the expense of an improvement is shared similarly by those affected.

Unique evaluations are generally paid off in installations over lots of years. Unique Assessments are constantly considered to be specific.

The Only Guide for Special Assessments Florida

Such audits shall be carried out in conformity with normally accepted auditing requirements as well as as necessary will include tests of the accountancy documents as well as other auditing procedures as may be considered needed under the conditions. Whether monetary reports as well as related products, such as components, accounts, or funds are rather offered,2.

This rate is constant as assured under Proposition 13 passed in 1978. What this means is that a $1 tax is enforced for every $100 evaluated worth of the residential property. Furthermore, under the stipulations of Proposal 13, any type of tax obligations imposed by any kind of governmental firm in addition to the 1% should be approved visit this website by 66 2/3% of the citizens.

All About Special Assessments Florida

Consequently, any type of rate you will certainly see in your tax expense added to the 1%, stands for a financial obligation or debts accepted by the voters. In Solano County, a lot of the property exhausted brings a citizen's debt. The citizen's financial debt prices are not uniform throughout the area since these depend on the round of impact of each firm that imposes it.

In Solano Area, there are around 75 exhausting entities. These entities consist of the region, schools, cities, collections, as well as unique areas. These companies obtain taxes to finance their operations to carry out the numerous solutions as required by law. The tax levied to any kind of residential property is shared by a mix of any one of the entities mentioned in the foregoing that service the area where the building being exhausted is situated.

If any of the foregoing events will result in a decrease in analyzed worth, an additional refund rather of a tax obligation is generated. In a couple of circumstances, damage of building due learn the facts here now to acts of nature can lead to an adverse modification that might result to an extra refund.

10 Easy Facts About Special Assessments Florida Described

Unique assessments are not component of the tax obligation rates. These unique assessments are independently determined in your tax bill by a four-digit code which starts with a 6, 7, 8, as well as in some uncommon celebrations with a 9.

The Real Estate Tax Division of the Auditor-Controller's Office (ACO) issues refunds as a result of corrections, allures, and so on that relates to previous years. In the majority of circumstances, visit this site these corrections are made by other departments associated with the process other than the ACO. On average refunds are made within thirty to forty-five days after the regular monthly refund record is obtained and also the called for documentation to support the refund is received.

Brand-new building and construction finished in your home. When this occurs, the Assessor's Workplace reassesses your building. With the exemption of the unique assessment, the tax prices utilized to compute tax obligations are quite much consistent.